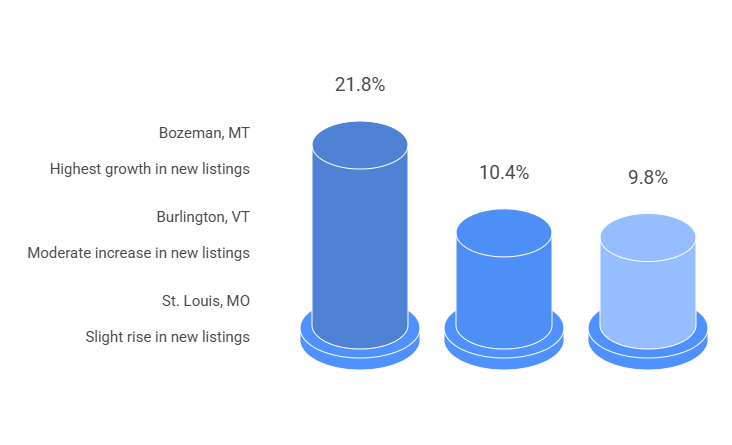

In the 51 metro areas surveyed in November 2025, the number of newly listed homes was down 8.3% compared to November 2024, and down 30.7% compared to October 2025. The markets with the biggest decrease in year-over-year new listings percentage were Dover, DE at -48.6%, Trenton, NJ at -48.3%, and Washington, DC at -45.2%. The markets with the biggest year-over-year increase in new listings percentage were Bozeman, MT at +21.8%, Burlington, VT at +10.4%, and St. Louis, MO at +9.8%

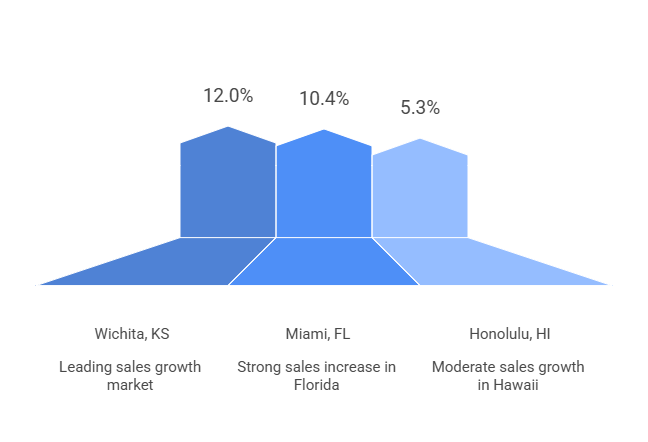

Of the 51 metro areas surveyed in November 2025, the overall number of home sales was down 4.7% compared to November 2024, and down 18.5% compared to October 2025. The markets with the biggest decrease in year-over-year sales percentage were San Antonio, TX at -22.9%, Bozeman, MT at -15.7%, and Anchorage, AK at -13.5%. The markets with the biggest increase in year-over-year sales percentages were Wichita, KS at +12.0%, Miami, FL at +10.4%, and Honolulu, HI at +5.3%.

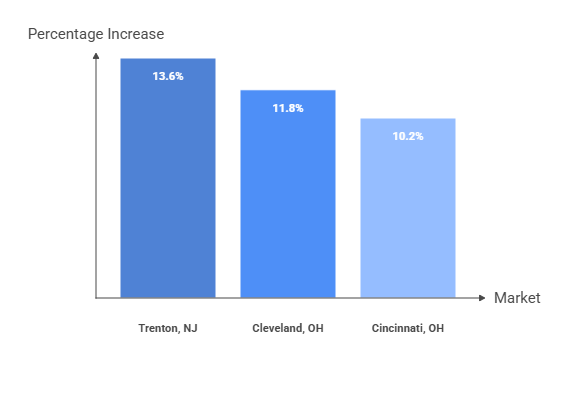

In November 2025, the median of all 51 metro area sales prices was $438,000 up 1.7% from November 2024, and down 1.5% compared to October 2025. The markets with the biggest year-over-year increase in median sales price were Trenton, NJ at +13.6%, Cleveland, OH at +11.8%, and Cincinnati, OH at +10.2%. The markets with the biggest year-over-year decrease in median sales price were Seattle, WA at -4.7%, Tampa, FL at -3.5%, and Richmond, VA at -2.5%.

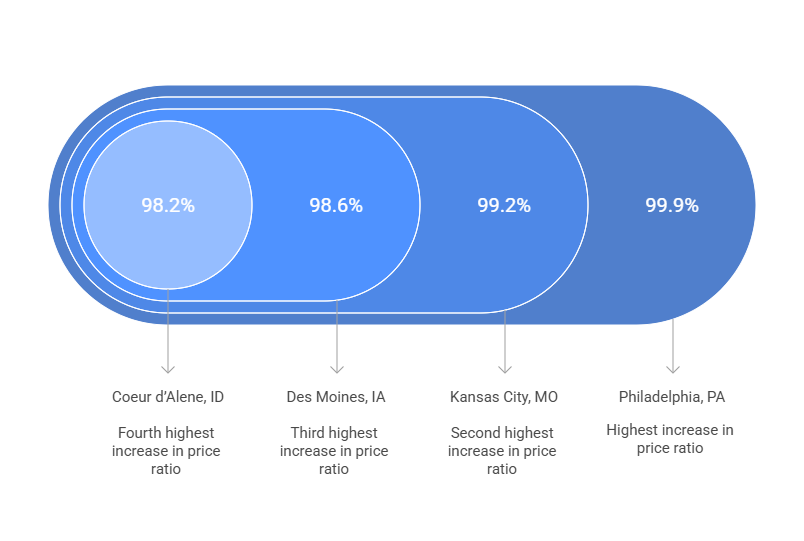

In November 2025, the average close-to-list price ratio of all 51 metro areas in the report was 98%, down from 99% in November 2024 and the same as October 2025. The close-to-list price ratio is calculated by the average value of the sales price divided by the list price for each transaction. When the number is above 100%, the home closed for more than the list price. If it’s less than 100%, the home sold for less than the list price. The metro areas with the biggest year-over-year decrease in close-to-list price ratios were Burlington, VT at -2.1 pp (98.3%), Dover, DE at -1.5 pp (98.6%), and Baltimore, MD at -1.2 pp (99.5%). The metro areas with the biggest year-over-year increase in close-to-list price ratio were Philadelphia, PA at +0.3 pp (99.9%), followed by Des Moines, IA (98.6%), Kansas City, MO (99.2%) and Coeur d’Alene, ID (98.2%) tied at +0.2 pp.

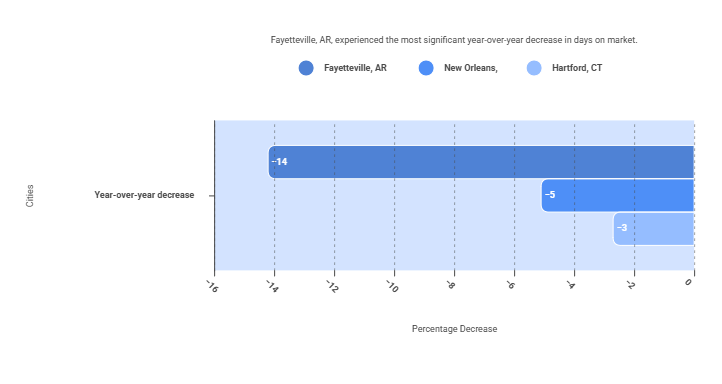

The average days on market for homes sold in November 2025 was 54, up seven days compared to the average in November 2024 (47) and up four days compared to October 2025 (50). The metro areas with the biggest year-over-year increase for days on market averages were St. Louis, MO at +39.1% (44 days), Manchester, NH at +38.7% (27 days) and Washington, DC at +28.7% (39 days). The markets with the biggest year-over-year decrease for days on market averages were Fayetteville, AR at -14.2% (65 days), New Orleans, LA at -5.1% (64 days) and Hartford, CT at -2.7% (24 days). Days on market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

November brought the expected seasonal cooling to the U.S. housing market, with fewer new listings and home sales compared to October as inventory levels remained elevated. Although the supply of homes declined 5.5% from October, it was still 14.5% higher than a year ago, marking the 23rd consecutive month of year-over-year inventory increases, a streak that dates to January 2024.

Buyers closed on 18.5% fewer home sales from October to November and 4.7% less than in November 2024, reflecting typical seasonal patterns.

November’s Median Sales Price of $438,000 posted a 1.7% year-over-year gain, continuing a 29-month growth streak that began in July 2023. Prices eased 1.5% from October.

“While some numbers reflect the typical seasonal slowdown, others point to encouraging trends,” said REMAX CEO Erik Carlson. “Inventory has continued to grow as prices have remained steady, pointing to a resilient market for both buyers and sellers. As the market continues to adjust heading into the new year, there’s plenty of opportunity to make a smart move, especially with guidance from a trusted REMAX agent.”

Other metrics of note:

One notable shift came in Seattle, a market that typically ranks among the highest in median sales price but saw its largest monthly price drop of the year, declining 5.4% from $740,000 in October to $700,000 in November. John Manning, local Broker/Owner of REMAX Gateway, says several factors may be contributing to the cooling trend.

“Seattle has enjoyed decades of incredible growth driven by Washington State’s appeal to a diverse mix of industries. More recently, shifts in tax policy appear to be influencing corporate decisions about where to allocate resources, which may be contributing to cooling home prices. We’re also seeing signs of wealth relocation, as higher estate taxes prompt some higher-net-worth residents, particularly seniors, to consider relocating later in life. At the same time, changes in the tech sector driven by artificial intelligence are reshaping hiring patterns that once fueled an influx of younger tech workers into the Seattle area.”

The RE/MAX National Housing Report is distributed each month on or about the 15th. The first Report was distributed in August 2008. The Report is based on MLS data in approximately 53 metropolitan areas, includes all residential property types, and is not annualized. For maximum representation, many of the largest metro areas in the country are represented, and an attempt is made to include at least one metro from each state. Metro area definitions include the specific counties established by the U.S. Government’s Office of Management and Budget, with some exceptions.

Transactions are the total number of closed residential transactions during the given month. Months Supply of Inventory is the total number of residential properties listed for sale at the end of the month (current inventory) divided by the number of sales contracts signed (pended) during the month. Where “pended” data is unavailable, this calculation is made using closed transactions. Days on Market is the number of days that pass from the time a property is listed until the property goes under contract for all residential properties sold during the month. Median Sales Price is the median of the median sales prices in each of the metro areas included in the survey.

MLS data is provided by contracted data aggregators, RE/MAX brokerages and regional offices. While MLS data is believed to be accurate, it cannot be guaranteed. MLS data is constantly being updated, making any analysis a snapshot at a particular time. Every month the RE/MAX National Housing Report re-calculates the previous period’s data to ensure accuracy over time. All raw data remains the intellectual property of each local MLS organization.